Navigation

Frequently Asked Questions

What is Social Reputation Score?

This is a proprietary Algorithm and software to rank available user profile according to several predefined parameters. The algorithm pulls information from online, mobile and social media platforms about the user (based on access granted by the user) to generate a Social Reputation Score. Every user is given a Social Reputation Score of a percentage ranging from 1% to 99%.

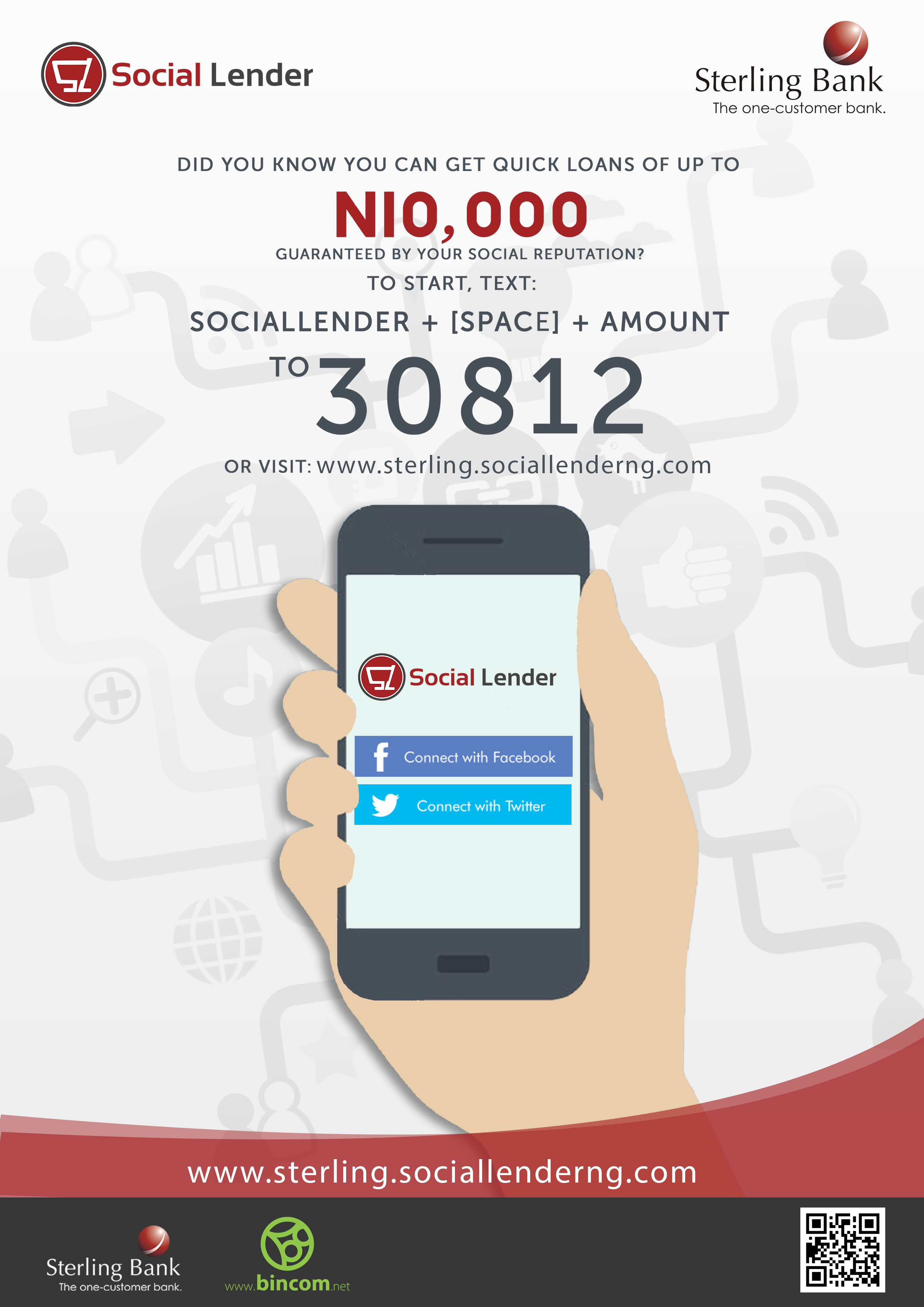

How much can I request?

Cash Requests on Social Lender ranges from a minimum of 1,000 Naira to a maximum of 100,000 Naira (maximum of 10,000 Naira for first few transactions, maximum of 3,000 Naira for first time users without Social Guarantors). The maximum amount increases over time based on frequency of successful transactions.

How much am I charged for the cash request?

Transaction Charge per Cash Request ranges from 5% to 20% of the disbursement amount. This is charged as part of the Repayment amount. It is also possible to get a much lower transaction charge to designated partner bank accounts on Social Lender.

What makes me eligible to request for cash?

Some basic information about the cash request is obtained from the User at the point of Cash Request.

Before a cash request is granted, The Social Credit Officers will carry out an extensive Social Audit on the Applicant, including reviewing the social reputation of the applicant and the applicant's Guarantor(s) (where applicable).

The Social Credit Officer makes the final lending decision on every cash request. Some users may be asked to provide additional "Social Collateral" to qualify for a cash request

If the cash request application is successful, the User is credited via existing banking channels.

Can I request for cash on Sterling Bank Social Lender Platform without a Sterling Bank Account?

Yes, all you need is an active Bank account from any Bank in Nigeria. You must not have a Sterling Bank Account to use the Sterling Bank Social Lender Platform. However applying with a Sterling Bank Account attract lower transaction charge. Note that your account must be older than 1 month with BVN and KYC done to be able to request for cash.

Who is a Social Credit Officer?

This officer is responsible for making a final decision on whether a cash request is granted or not. Should the Credit Officer not be satisfied, he or she can call on the customer/user to submit additional details in form of additional social collateral.

When am I expected to pay back?

Users will indicate the date of payback as part of the cash request process. Maximum Lending Period is currently one (1) month for the first few transactions on Social Lender. The requester should pay back cash into the Social Lender designated bank account (A/c Name: Social Media - Bank: Sterling Bank - A/c No: 0026503494) on or before the due date. Ensure your full name or verified mobile number is indicated in the repayment for automatic reconciliation.

How do I pay back?

Cash Requests can be repaid using existing banking channels including Mobile Money, bank or online transfer, physical payment at bank, online bank transfer, online payment switch, and other payment options available in the country of operation.

In a situation where a user is not be able to repay the cash request by the repayment date, user must roll over the cash request, this may be recognized as a new cash request. However, the user MUST pay the transaction and service charge by the end of the repayment period regardless of repayment of the principal.

If a cash request becomes ‘Un-serviced’, we shall commence our cash request retrieval process as indicated in the Social Lending Agreement.

Why You need Friends on Social Lender?

On Social Lender, Access to Microcredit is based on your Social Reputation in your Social Community. The higher your Social Reputation Score, the higher the loan amount you qualify for. One of the ways to determine your social reputation is through your Friends, Family & Connections on the Social Lender Platform. Social Lender also requires you to have valid Social Lender Friends, Social Referees or Social Guarantors on the platform to be able to get Cash Disbursed.

Please note that your Social Referees and Social Guarantors will need to confirm your request in all cases.

What if my Social Referees / Social Guarantors are not on Social Lender?

You can also send a message directly to your Social Referees or Social Guarantors to approve your request without having to complete the full Social Lender Registration process. Please note your Social Guarantors may need to verify their Bank Details to make them valid.

Why are my Social Lender Friends not "Valid"?

Please note that you might have Social Lender Friends / Social Referees / Social Guarantors on the platform but they might not be currently valid.

“Invalid” Friend is a state on Social Lender which may mean your friend has incorrect details on Social Lender or needs to include additional details or have pending liabilities on Social Lender or other similar reasons. This is usually a temporary state.

We unfortunately are not able to provide the exact reason for the friend being “invalid” to you as we have to respect the privacy of your friend. The reason is usually available on the Users’ dashboard. You can also have the friend contact our support team to provide more information.

We advise that you add different friend(s) in place of this friend(s) while we resolve the issue (if any) with your current friend.