Navigation

About Social Lender

Social Lender is a lending solution based on social reputation on mobile, online and social media platforms. Small cash requests are offered to members of Social Lender communities with a valid bank account. Cash requests are guaranteed based on the user’s Social profile and reputation.

To begin the process, the User’s Social Media information/profile is assessed based on a proprietary Social Algorithm to calculate a user’s Social Reputation Score. Users are eligible for a cash request with a minimum social reputation score (see scoring) and cash requests are granted on a case by case basis after extensive Social Audit on the requesting user is carried out by one of our Social Credit Officers

Some of the factors that affect Social Reputation Scores and eventually getting a cash request include:

- The social information available about the user.

- The duration of activity on the social network.

- The investigation done by our Social Credit Officer.

- Additional Social Collateral submitted by user.

- Validation of the Social Guarantors provided by the user.

BENEFITS OF SOCIAL LENDER

- Users get fast cash on the go as at when needed at low cost

- Withdrawal of requested cash is bank independent as the money can be withdrawn from any existing banking channel including ATM machines.

- Transaction is confidential (only the Requester, the Social Cash Request Credit officer and in some cases the guarantor are involved in the cash request process)

- Users have potentials of getting higher cash request. The more a user uses the service (and payback as at when due), the higher the trust rating, hence the higher amount the user can request at a time.

User’s whose social reputation doesn’t add up to the required minimum may be able to augment their score by requesting for a guarantor on the system. The more guarantors a user has on the system, the higher the eligibility for cash requests (regardless of the social reputation score). Possible list of guarantors are retrieved from a list of user’s friends (or followers) who are also using Social Lender Application.

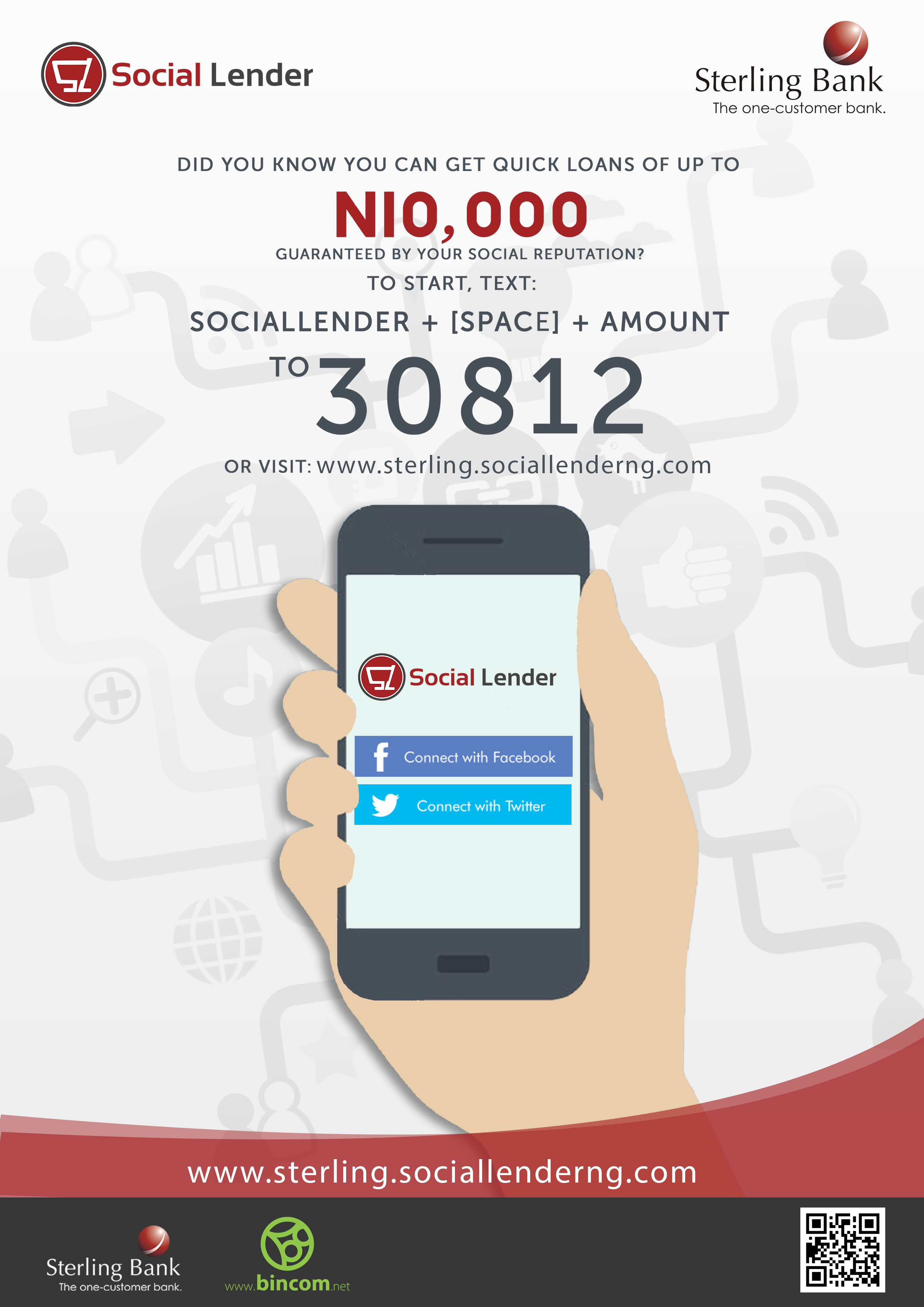

THE CASH REQUEST

Cash Requests on Social Lender ranges from a minimum of 1,000 Naira to a maximum of 100,000 Naira (maximum of 10,000 Naira for first few transactions, maximum of 3,000 Naira for first time users without Social Guarantors). The maximum amount increases overtime based on frequency of successful transactions.

CASH REQUEST DISBURSEMENT

The Cash Request is paid directly to the Requester’s Bank Account. This account is verified as part of the registration process on the platform. Users are credited via existing and regular banking platforms and maximum duration of the cash request is determined by the partner financial institution ( Sterling Bank ) (usually 30 days) with a service charge as defined by the partner. Transaction Charge per Cash Request ranges from 5% to 20% of the disbursement amount.

CASH REQUEST REPAYMENT

Cash Request can be repaid using existing banking channels including mobile money, bank or online transfer, physical banking, Online Bank Transfer, Deposit in branches, online payment switch, Mobile Money Transfer and other payment options available in the country of operation.

In a situation where a user is not be able to re-pay the cash request by the end of a 30 day period, user must roll over the cash request , this may be recognized as a new cash request. However, the user must repay the transaction charge by the end of the 30 day period regardless of repayment of the principal.

If a cash request becomes ‘Unserviced’, we shall commence our cash request retrieval process as indicated in the Social Lending Agreement.